- Article

- Growing my Business

- Enable Growth

- Seeking New Opportunities

How Centralised Treasury operations can help consolidate growth in Asia

If your company is seeking to accelerate its Asia expansion plans and streamline financial operations, consolidating treasury activities in a single location can help. In this article, we explain why a regional treasury operation in a thriving hub such as Singapore can enable businesses to drive operational efficiency, reduce costs and minimise financial risks. If you’re looking to take action now, speak to us today

Benefits and key considerations of setting up a centralised treasury

For many global companies based in Southeast Asia, the treasury function lies right at the heart of decision-making. That is not surprising when you consider that it is the corporate treasury that provides an organisation with its access to capital markets, supports its mergers and acquisitions activity, and strengthens its visibility, and control over day-to-day operations.

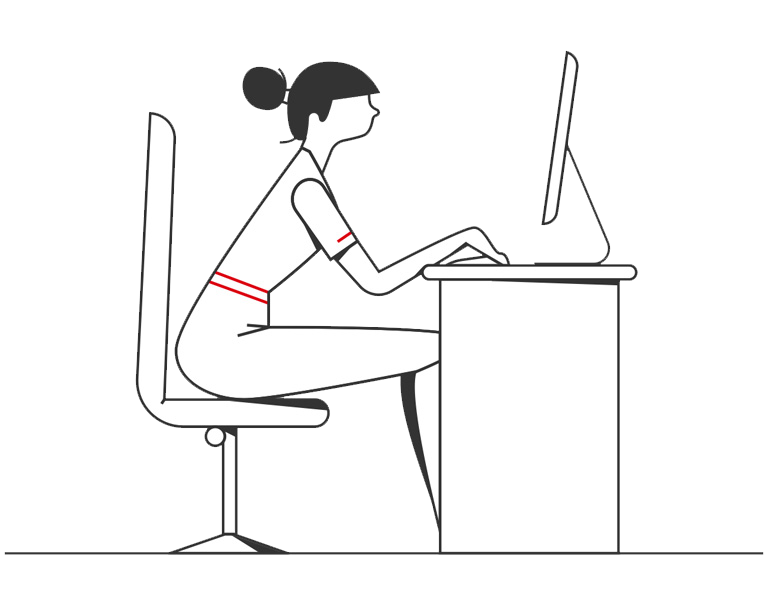

This vital decision-making role is only magnified when an international corporation with established regional operations seeks to scale further and enter more new markets. In this diverse region, where companies can struggle to navigate varied banking protocols, comply with different regulations and monitor for potential changes in foreign exchange, a poorly functioning treasury department can cause critical setbacks.

For example, a treasury that lacks adequate visibility over cashflows across its operations can put the firm in the position of being unable to meet its liquidity requirements. A lack of local treasury know-how in any particular market can hamper relationship-building and operations across the region, resulting in delays in execution and potentially higher costs.

So what can global companies seeking to manage their growth in Southeast Asia do to overcome these challenges?

Centralise treasury operations for improved efficiency and control

Setting up a regional treasury centre (RTC) with specialist processes and controls can allow companies to support their expansion in a region that has some of the world’s fastest-growing economies. Centralising banking relationships and control over cash also creates economies of scale and enhances connectivity.

At the same time, regional treasurers have better visibility over group liquidity. Used effectively, this insight can help to reduce overall borrowing, negotiate financing and leverage the company's credit rating.

“What underpins the decision to set up a finance and treasury centre is the ability to centralise operations and, therefore, save money. In essence, financial and treasury centres (FTCs) are a highly efficient way to reduce the tax burden, centralise risk management, improve liquidity and enhance yield on cash,” KPMG tax specialists Chiu Wu Hong and Harvey Koenig said in a recent report.

Base the treasury centre within a thriving financial ecosystem

A recent study found that locating treasury operations within a well-developed, well-regulated and open financial ecosystem is a key factor when it comes to managing a successful regional expansion plan.

Singapore – the world’s third-largest foreign exchange trading hub – is often named as Asia’s top treasury location. Companies using the city-state as a base for all their finance, treasury and banking activities are able to take advantage of Singapore’s efficient banking system, liberal foreign exchange convertability regulations and ease of doing business.

As a tax-efficient and open financial centre, Singapore attracts a deep talent pool with the multinational financial experience that treasure centres require. It also offers a wide and liquid financial market in which to trade, an open eco-system that allows maximum coverage, and a tax regime that supports treasury effectiveness.Regional treasury centres based here can also take advantage of tax incentives such as the Finance and Treasury Centre (FTC) Incentive, which allows approved companies a reduced corporate tax rate on certain activities, among other things.

Singapore's thriving financial technology (FinTech) industry also presents opportunities for companies to modernise their treasury and cash management functions through digital solutions.

Given these varied strengths, it is not surprising that a wide range of multinational corporations are already using the city-state as a regional hub. The roll call of household names includes the BMW Group, Dow Financial, General Electric, Johnson & Johnson, Nestlé, Mitsubishi Heavy Industries and Samsung.

Leverage technology to streamline risk

A further major benefit of a centralised treasury is that it enables businesses to adopt a uniform approach to managing finances in various markets, which in turn streamlines risk and has an impact on liquidity and costs.

It means, for example, that a corporate treasurer can take a holistic view of the company’s financial position across markets in order to manage foreign exchange and interest risks through effective hedging.

“There are 48 countries in Asia with a variety of cultures, languages, currencies and government systems,” Francois-Dominique Doll, Executive Director for Global Treasury Advisory Services at Deloitte recently told Treasury Today Asia.

“Because of this diversity, establishing a regional treasury centre will create a financial structure that can concentrate cash, manage risk exposure centrally and hedge different currencies with a standardised process.”

At the same time, many global businesses are increasingly adopting digital solutions such as application program interfaces (APIs) and data analytics to improve speed and accuracy, reduce costs and increase scalability. This enables better control and risk management across the region.

To support this shift, companies should ensure that their banking partner can offer a comprehensive range of treasury solutions that include digital transaction banking services, distributed ledger technology, automated collection solutions and more.

Find a banking partner that can support agility and help optimise working capital

Global companies need to be agile if they wish to remain competitive and have the opportunity to grow market share.

HSBC, with its extensive network across Asia Pacific and market-maker of many Asian currencies, is uniquely placed to help corporates capitalise on Asian growth opportunities, thanks to our deep experience supporting some 500 regional headquarters in Singapore.

For example, we help companies establish cross-border or domestic cash pools to optimise their liquidity position and minimise any working capital gaps and funding costs.

We can also help enhance their interest yield at a regional level, and provide instant overviews of total balances across the region via our unified digital platform, HSBCnet.

At the same time, we can provide structured trade and commodity finance solutions to help businesses mitigate various country and counterparty risks.

By taking advantage of this expertise, international companies with regional hubs in Singapore can advance their regionalisation strategies and better connect to growth opportunities.

Our digital innovation – including our use of distributed ledger technology such as blockchain – and our focus on improving sustainability contributed towards HSBC being named Transaction Bank of the Year for Asia Pacific at the Transaction Banking Awards 2021, organised by The Banker. Euromoney also named HSBC Asia’s Best Bank for Transaction Services in 2021.

Bespoke solutions for international subsidiaries

Our banking solutions have been designed to meet your requirements.

This document is issued by The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch (UEN S16FC0010A) (“HSBC”). HSBC does not warrant that the contents of this document are accurate, sufficient or relevant for the recipient’s purposes and HSBC gives no undertaking and is under no obligation to provide the recipient with access to any additional information or to update all or any part of the contents of this document or to correct any inaccuracies in it which may become apparent. Receipt of this document in whole or in part shall not constitute an offer, invitation or inducement to contract. The recipient is solely responsible for making its own independent appraisal of the products, services and other content referred to in this document. This document should be read in its entirety and should not be photocopied, reproduced, distributed or disclosed in whole or in part to any other person without the prior written consent of the relevant HSBC group member. This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.