- Article

- Growing my Business

- Enable Growth

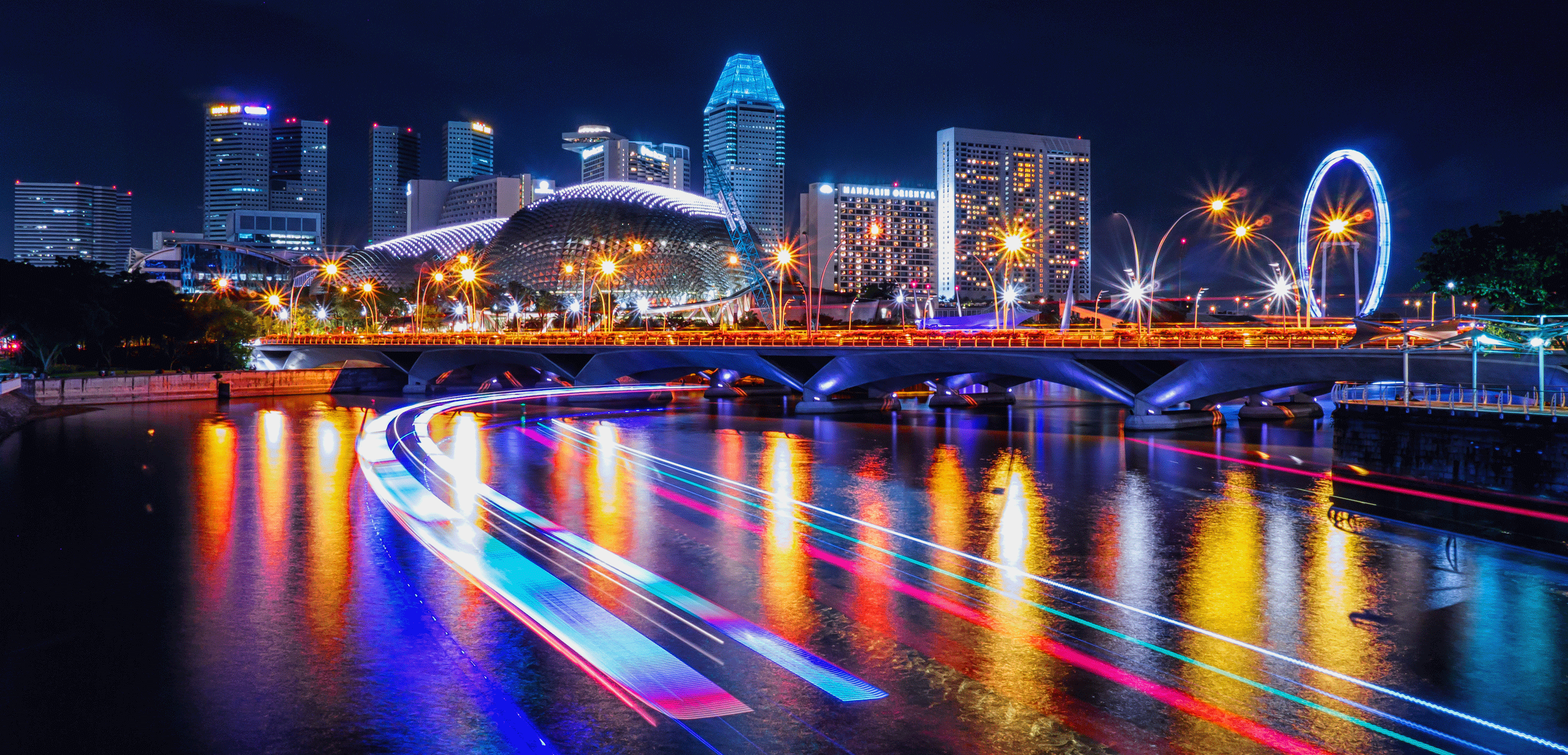

HSBC steps up Asia-for-Asia strategy with its corporate and institutional banking business in Singapore

A longstanding part of Asia’s commercial fabric, HSBC is sharpening how it grows and supports businesses in the region through its corporate and institutional banking (CIB) business in Singapore. The city-state is a gateway to Southeast Asia, bridging capital, talent and trade, and its corporates are leaning further into the region despite global uncertainty.

According to HSBC’s Global Trade Pulse published in November 2025, 53% of Singapore businesses and 41% of firms across Asia plan to increase their reliance on Southeast Asia. Singapore companies also report stronger supply-chain resilience and greater risk-management confidence than six months earlier. While trade remains volatile, 79% of Singapore businesses are optimistic about growing international trade over the next two years as an Asia-for-Asia pattern takes shape.

In 2025, the spotlight was on HSBC’s launch of innovation banking in Singapore, with a dedicated US$1.5 billion ($1.92 billion) pool for high-growth companies. With this, its CIB business in Singapore can support companies from across the corporate lifecycle — from venture-backed start-ups and scale-ups to mid-market firms, multinationals and institutions.

“Innovation banking completes for us the client spectrum in terms of the overall wholesale banking client segments we want to serve,” says Gilbert Ng, head of banking, corporate and institutional banking, at HSBC Singapore.

Enhanced coverage model supporting start-up to institutional

The bank’s client coverage model brings four segments under one roof in Singapore: institutional, global corporates, international mid-market and innovation banking. The aim is to provide a single relationship path as businesses scale and expand internationally.

Be it a founder at Series A, a mid-market company expanding across borders, or an institutional investor managing cross-border portfolios, HSBC has the capability and solutions to serve their needs through CIB.

Singapore is the 10th market where innovation banking was launched, joining Australia, continental Europe, Hong Kong, India, Israel, mainland China, New Zealand, the UK and the US. “We are now able to connect ideas, capital and transactional requirements across these 10 markets, which are all innovation hubs themselves,” says Ng.

Innovation banking is designed as a catalyst for the venture ecosystem. The US$1.5 billion pool in Singapore complements CIB’s broader capabilities, giving high-growth companies capital, working-capital support and market access alongside HSBC’s international network. Execution capacity is built around a dedicated group of bankers focused on the innovation economy and connected across markets, so sector expertise and cross-border support can be brought to bear quickly as companies scale.

Ng adds that HSBC is preparing for 2026 with a founder-first approach. This includes deepening engagement with venture capital firms, collaborating with HSBC Global Private Bank to support innovation-led entrepreneurs’ personal wealth needs alongside their company banking, and scaling transaction and financing solutions to support their overseas expansion needs.

The go-to-market model consolidates relevant clients — founders and their investors — into innovation banking so they can access a dedicated team and a single set of solutions, rather than being served by different client segment teams in CIB.

The offer is built on liquidity first. Most venture-backed clients use global banking and cash-management services, while only a minority borrow at any one point, typically 20% to 30%. Portfolio composition mirrors where global venture funding is deployed, with a strong tilt to technology and a meaningful allocation to life sciences. In Singapore, fintech will have a larger share given the market’s strengths and the region’s consumer scale. To help early-stage start-ups get started, HSBC is offering a no-tariff starter suite that bundles core banking needs so founders can focus on building. The bank’s main entry point is Series A, though it also serves founders coming out of proven accelerators, teams with early product-market fit and serial entrepreneurs who are scaling their next ventures.

Universal banking capabilities powering growth

HSBC’s universal banking model brings together transaction services, financing and advisory with personal banking capabilities for entrepreneurs.

Global payments solutions and global trade solutions support cross-border cash, liquidity, collections, payables and working capital across time zones. The bank is investing in digital rails that make this easier, from streamlined onboarding to tools that simplify collections and enable working-capital access and supplier payments on near real-time cycles. The objective is to reduce friction so leadership teams can devote time to products, customers and market expansion while banking runs reliably in the background. Financing and advisory services cover capital markets, structured finance and sustainability-linked instruments. These are used to support scale-ups that need to finance growth and M&A, corporates executing transformation projects and institutions seeking diversification and risk management. For institutions, markets and securities services provide liquidity, FX and risk solutions, and custody and fund services, all aligned with the same Asia-centric trade and investment corridors.

The practical focus is on matching the rhythm of cash flows and the pace of growth with the right mix of liquidity, payments, trade finance and funding, so companies can scale without compromising control.

A key advantage in Singapore is that corporate needs and personal wealth needs can be addressed under one roof. Alongside CIB, HSBC’s retail and private banking arms provide entrepreneurs with a pathway to manage personal liquidity, investments and wealth planning as their companies grow. HSBC Singapore has recently introduced an entrepreneur solution within its Global Private Bank business to link personal and business banking needs for its innovation banking clients as it recognises their financial decisions are often intertwined with their companies’ growth and funding cycles.

Ng says the bank’s role is to bring network, product depth and local knowledge together in a way that matches founders’ ambitions. The bank’s ability to combine its frictionless corporate banking service model with its digital-led transaction banking solutions and strong financing capabilities, plus personal banking services for entrepreneurs, aims to make HSBC a single partner for clients as they expand.

Asia-for-Asia gains momentum into 2026

The opportunity set for Singapore corporates and institutions is being reshaped by an Asia-for-Asia dynamic. Asean’s scale and digitisation, India’s momentum and deep connectivity with Singapore, and China’s extensive trade and investment links with the region are all reinforcing Singapore’s role as an orchestrator of trade, capital and talent flows. The expanding consumer base in Southeast Asia, an e-commerce and digital services surge, and the rise of new-generation brands crossing borders are driving demand across the electronics, mobility, education, healthcare and leisure markets. Policy tailwinds, such as the impending upgrade to the China-Asean Free Trade Area, are expected to lower barriers further and accelerate integration.

HSBC’s Global Trade Pulse report indicates that firms in Asia are adapting to trade-policy volatility. More than two-thirds (68%) of Asian respondents feel more certain about the impact of trade policy than six months earlier. As the tariff environment settles, companies expect supply-chain disruption to have a smaller negative impact on revenue than it did mid-year, with the average two-year hit easing to 13% from 18%. In Singapore, 57% of businesses are more certain about trade policy effects than they were six months earlier. The share of companies expecting significant revenue losses of over 15% from supply-chain disruption has fallen to 40%, down from 72%, signalling better risk management and more resilient operating models.

Costs remain a pressure point, with a large majority expecting higher input, freight or tariff costs. Even so, Singapore businesses are acting on growth plans. Just over half intend to enter new markets, diversify revenue streams or rebalance their product and service mix over the next two years. Markets where Singapore firms are increasing sales include Malaysia, Australia, India, mainland China and Japan. Within technology, media and telecoms, Singapore companies are raising exposure to Malaysia at rates well above the global average, reflecting the strength of manufacturing and digital infrastructure in the corridor and the ease of operating from a Singapore base.

For Chinese and Indian companies, Asean is a natural next market. The region’s expanding middle class — expected to reach around 70% of the population by 2030 — and its young, connected consumers are attracting both global and regional brands. Singapore’s role as a financial, legal and digital hub positions it as a staging ground for expansion in either direction. It is both a distribution node and a centre for structuring cross-border finance, FX and risk solutions. Singapore-based firms that can connect products with last-mile execution and embedded financial services are likely to benefit from this shift, particularly in sectors where data, payments and logistics converge.

HSBC is aligning to this demand pattern in three ways. First, by providing the liquidity, payments and trade finance needed to operate across multiple hubs in Southeast Asia and beyond. Second, by making capital available to high-growth companies through innovation banking’s dedicated pool and through capital markets and advisory solutions for larger transactions. Third, by reinforcing the ecosystem around founders and investors, including through partnerships that expand knowledge and market access.

“Clients that need a bank with reach, resilience and reliability on a global scale turn to us,” says Ng. “We support them not only with products, but with the full force of our network, insights and people.”

Source: The Edge Singapore. Permission required for reproduction