Whether you are setting up a new subsidiary or regional headquarters, we are uniquely placed to support your ambitions through the process of change.

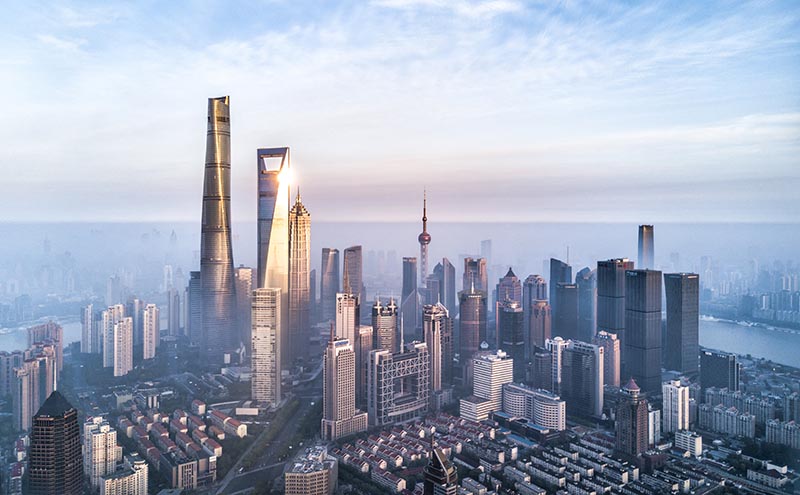

From optimising your business through technology or expanding into new sectors and markets, our extensive experience in trade and finance can help you grow across the region right from Singapore, a leading financial and commercial hub.