HSBC Global Wallet for SMEs

Do business across 240+ countries and territories with HSBC's all-new multi-currency wallet designed for SMEs.

Do business across 240+ countries and territories with HSBC's all-new multi-currency wallet designed for SMEs.

About HSBC Global Wallet

Key Benefits

Transact faster with pay and receive like a local

HSBC Global Wallet lets you pay like a local in AUD, CAD, CHF, CNY, EUR, GBP, HKD, JPY, MYR and USD within the same or next day.

You can also receive payments locally or from across the world into your HSBC Global Wallet AUD, GBP, HKD and USD accounts.

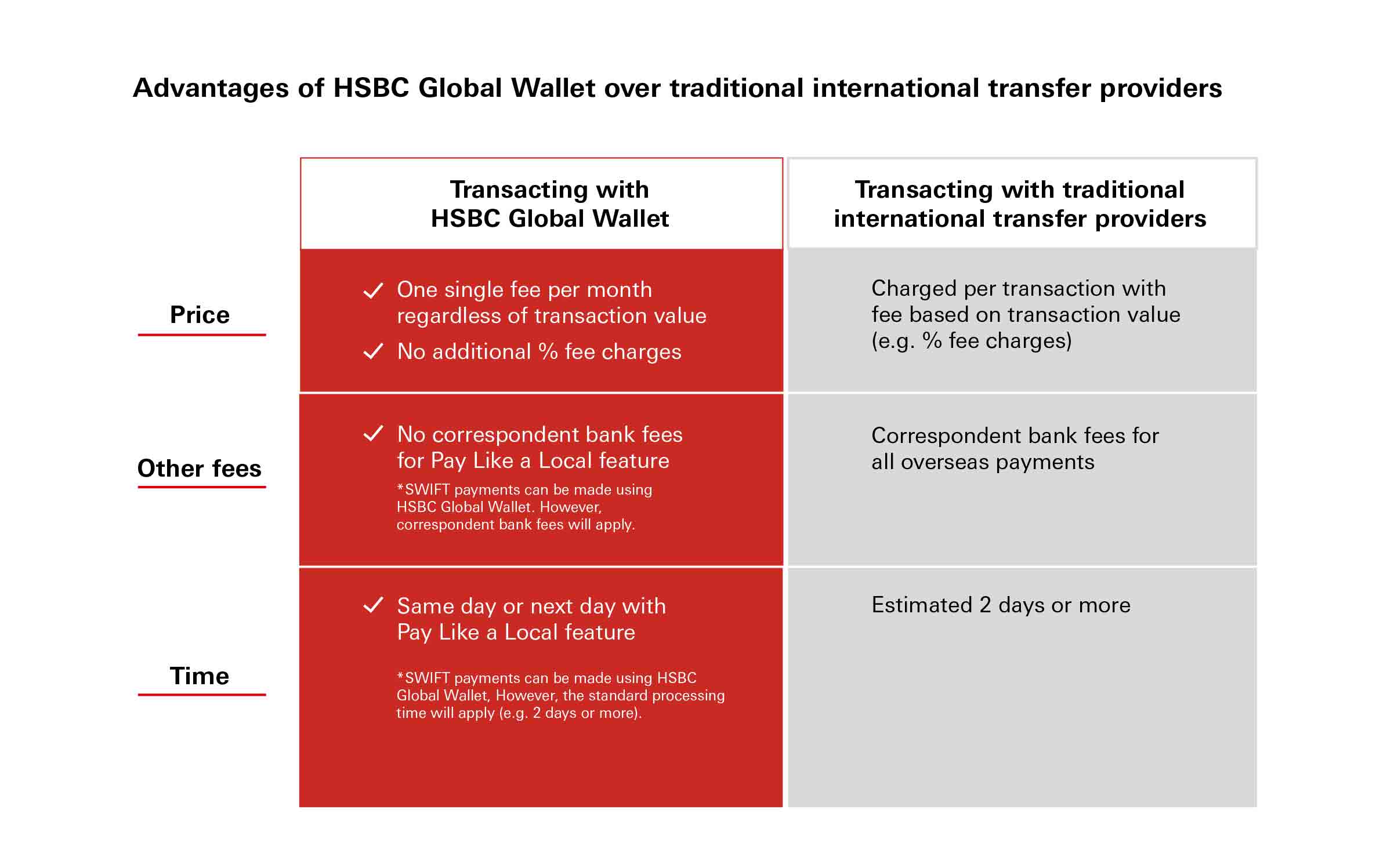

Lower fees, no multiple charges

Reduce your transaction costs with our new flat fee pricing packages and enjoy savings on wire charges. There are no corresponding fees for paying as a local.

One single, secure platform.

Access your global wallet via one easy-to-use consolidated interface that helps you manage business payments, receivables and liquidity – our award-winning banking platform and mobile app, HSBCnet.

Available currencies and destinations

Send payments

Send payments via SWIFT to 240+ countries and territories in AED, AUD, CAD, CHF, CNY, CZK, DKK, EUR, GBP, HKD, MXN, NOK, NZD, PLN, SAR, SEK, SGD*, THB, USD and ZAR

Pay like a local to Australia, Canada, China, Hong Kong, Japan, Malaysia, Switzerland, United Kingdom, United States and most of Europe.

*SGD priority payments to a SG beneficiary is not permissible, however it is available for a foreign beneficiary.

Receive payments

Receive SWIFT payments from 240+ countries and territories into your HSBC Global Wallet AUD, HKD, USD and GBP accounts

Receive like a local

- like a local from Australia, Hong Kong, United Kingdom and United States into AUD, HKD, GBP and USD wallet respectively using local addressable information in each destination.

- from Hong Kong into CNY wallet as well using local addressable information.

Hold funds

Hold funds in multiple currencies such as AUD, CAD, CHF, CNY, EUR, GBP, HKD, JPY, SGD, and USD all in one place with no fall below account fees.

Click here to see full list of currencies and destinations you can pay or receive from.

We are pleased to announce that HSBC Global Wallet has won the B2B Payments Innovation of the year at the Payments Awards 2021!

I want to …

Know more about HSBC Global Wallet

Watch this video on how HSBC Global Wallet can help your international business needs.

Find out how businesses can save money with HSBC’s multi-currency wallet.

Hear from Winnie Yap, HSBC’s Head of Global Payments Solutions, as she explains how HSBC Global Wallet helps SMEs reduce transaction costs when doing business overseas.

FAQs

Request a call back

Business Account Opening

Interested in opening a business account with us?

This form is intended for businesses enquiring about opening an account with us. By providing details about your business, we will review and connect you with one of our Relationship Managers for assistance. All fields are mandatory unless stated otherwise. Please do not enter confidential information such as bank account details here.

If you are an existing customer, please contact your Relationship Manager or our Customer Service Hotline at 1800 216 9008 (Singapore) +65 6216 9008 (From Overseas).

Otherwise, you can also contact us via our Virtual Assistant on our website for general enquiries.

For information on our fees and charges, please refer to our standard tariff here.

This payment solution is not applicable for standing instructions, payment advices, cash deposits and cash withdrawals, Cheques, Singapore domestic payments, file-based payments. Send ‘local’ payment feature in EUR is also not available to the following destinations: Aland Islands, Saint Barthelemy, French Guiana, Gibraltar, Guadeloupe, Monaco, Saint Martin, Switzerland, Martinique, Saint Pierre and Miquelon, Reunion, Serbia, San Marino, Mayotte.

DEPOSIT INSURANCE SCHEME

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

This page summarises key product features and is intended for your general information only. It shall not be capable of creating any contractual commitment on the part of The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch.

Discover more

Need help?

Get in touch to learn more about our banking solutions and how we can help you drive your business forward.