- Article

- Sustainability

- Transition to Net Zero

- General Sustainability

Building a Sustainable Future: How Industrials and Chemicals Companies are Navigating the Net Zero Journey

Companies in the carbon-intensive industrials and chemicals sector see decarbonisation as a strategic priority and are exploring commercial opportunities in the transition.

The industrials and chemicals ecosystem is a critical part of the global economy, producing materials that are essential in our everyday lives. Many of the most carbon-intensive industries – such as steel, cement or plastics – are also the most difficult to decarbonise. They require very high heat or rely on processes that produce carbon dioxide, and they are manufactured in expensive facilities built to last for decades.1

Nonetheless, industrials and chemicals businesses will need to substantially cut their emissions if the world is to remain in sight of the 1.5°C temperature limits targeted under the Paris Agreement. To reach net zero by 2050, the industrial sector’s total direct emissions – which account for 30% of the global total2 – would, on current projections, need to fall by almost a quarter by 2030, or about 3% per year, according to the International Energy Agency.3

To understand how businesses in this sector are responding to this challenge, HSBC worked with research company Kantar to survey 375 companies globally across the industrial ecosystem, including steel, chemicals and plastics, construction materials, other metals and mining, paper, forestry and glass.

The survey is the latest in HSBC’s Transitions Pathways programme, which examines heavy-emitting industries. Our pathway explains how companies in the industrials and chemicals sector are approaching the transition, where they are on their journeys to reach net zero, and their related financing strategies.

Transition planning and reporting

The survey shows that companies in the sector see the transition to net zero as important for their bottom lines. Almost all respondents (98%) said the transition was commercially important. That is especially true for business-to-consumer (B2C) companies, with more than half (53%) saying transitioning to net zero is their top priority, versus 34% of business-to-business (B2B) firms, underlining the importance of consumer pressure in driving action.

This level of strategic importance is reflected in transition planning. Over three quarters (78%) of respondents consider themselves to have a transition plan in place or are developing one, with both B2C and larger companies – those with turnover of USD2.5 billion or more – the most likely to have formal plans.

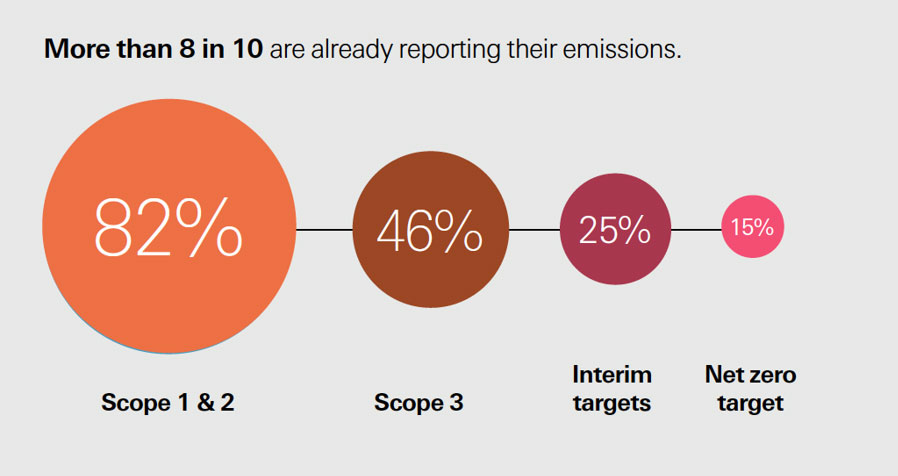

Businesses in the survey are also developing a clearer picture of their carbon footprint. 82% of respondents say they are reporting scope 1 emissions (those produced directly and scope 2 emissions (those generated indirectly, such as by the energy the company uses). In the US, where the securities regulator has proposed mandatory reporting of carbon emissions4, the proportion of companies doing so is even higher, at 94%.

Reporting of scope 3 emissions5 is widespread, with almost half (46%) reporting on emissions in their value chain. That is almost the same figure as the 45% of real estate businesses doing so, but a far bigger proportion than the 17% of companies doing so in the energy sector and 16% in the transport and logistics sector.

Some industrials and chemicals sub-sectors are more likely to report scope 3 emissions than others: 54% of construction & building materials companies say they do so, compared to 46% of all businesses surveyed.

“Scope 3 disclosure is a particular challenge in the manufacturing sector, where many companies operate in the middle of complex global supply chains,” says Rohit Moudgil, Head of UK Industrials and Manufacturing at HSBC. “Businesses will need to address this as pressure from regulators and customers increases.”

Opportunities and catalysts

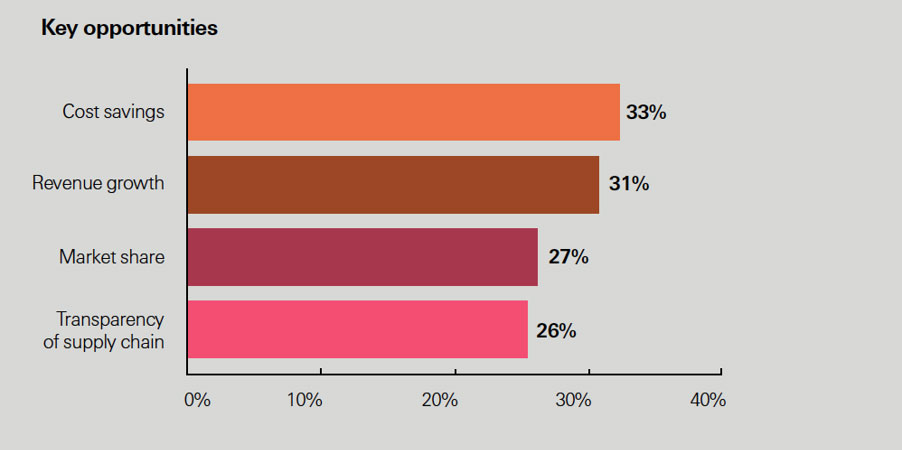

Industrials and chemicals companies also recognise that the transition will present a broad range of business opportunities. Respondents point to the potential for revenue growth, improved supply chain transparency and risk mitigation. Cost savings and efficiency gains are especially important in the Americas region, with 40% of businesses citing this as a top-three opportunity.

On a similar note, industrials and chemicals companies see technology developments as the most important accelerator for progress on the low-carbon transition, as was the case for energy, transport and logistics and real estate businesses surveyed by HSBC earlier in our programme.

Most respondents believe the technology necessary to get to net zero already exists and are working on adopting it. Paper makers and glass manufacturers are leading the way, with 86% saying they have adopted, or are in the process of adopting, the technology they need.

The biggest constraints to adopting new technology are limited supply/availability and cost, with 15% and 10%, respectively, of respondents citing these factors. Such concerns are particularly acute for certain sub-sectors: around one-third of manufacturing businesses and one-third of European companies said they are struggling with limited supply and cost of new technology.

Policy/legislation is the top external driver of net zero strategies, with 34% of industrials and chemicals companies listing it among the top three influencers. This underscores the impact of frameworks such as Europe’s Carbon Border Adjustment Mechanism,6 which will introduce carbon-related tariffs on imports of steel, cement, aluminium and other carbon-intensive materials from 2026, as well as the US Inflation Reduction Act7 and Europe’s Green Deal Industrial Plan,8 which provide incentives to encourage the development of low-carbon technologies.

“Policy frameworks are opening up new opportunities across the industrials and chemicals sector. Greater investment into clean-energy technologies will drive demand for materials and chemicals needed such as to produce batteries and solar panels,” says Michael Willoughby, Global Head of Metals, Mining and Transition Materials at HSBC. “Companies that can scale up the supply of these critical materials will be well placed to gain market share.”

To do that, it is not only factors such as cost and policy that are important, but also the availability of talent, particularly in certain sub-sectors. For instance, 28% of steel companies cite skills shortages in the market as a barrier to progress. It is a similar story for mining of other critical minerals like lithium and nickel, which face a deficit of skilled mining labour, says Willoughby.

Capex priorities

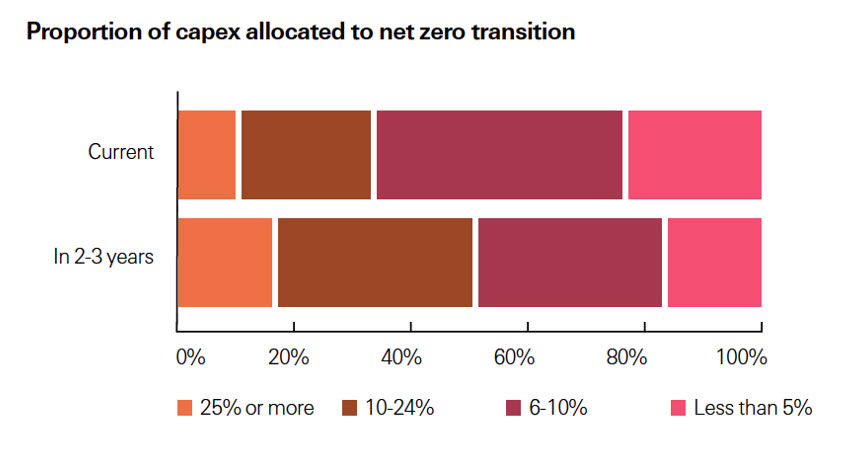

Companies in our survey recognise the need to increase their investment in transition-related activities. Thirty-five percent of those surveyed are currently spending more than 10% of their capex on the net zero transition, while 54% plan to do so in the next two to three years.

One in three (34%) expect their transition-related capex investments to deliver a higher yield than other spending. That’s particularly true in the steel sector, where companies are building green steel projects to meet the demand: 56% are confident of generating a premium on their green capex spend.

The top priorities for transition activities are switching to low-carbon materials (22%), electrification of operations (18%) and energy-efficiency improvements (16%). However, there is a gap between actions and impact: while 37% (the biggest proportion) say the electrification of onsite processes will have the biggest impact on carbon emissions, only 18% have taken this action. Similarly, while 31% suggest electrification of transport will have the highest impact, only 17% say they have done it.

“We can see that industrials and chemicals companies are taking real steps to reduce their emissions, but much more is needed to get the sector on track to net zero,’ says Sophie Lu, Global Head of Heavy Industry Decarbonisation at HSBC. “The industry needs to ramp up investments in electrification and scale up new technologies like green steel and green chemicals, and this will take time. We need to be planning for the long term today.”

After all, decarbonising the materials that serve as the building blocks for transition technologies will provide a solid foundation for net zero progress.

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. Find out more: https://www.hsbc.com/who-we-are/our-climate-strategy

Transition Pathways: Industrials and Chemicals

Explore more of the findings and insights on the industrials and chemicals sector.

1 https://www.brookings.edu/articles/the-challenge-of-decarbonizing-heavy-industry/

2 https://www.weforum.org/agenda/2022/01/decarbonizing-heavy-industry-industrial-clusters/

3 https://www.iea.org/energy-system/industry

4 https://www.spglobal.com/esg/solutions/getting-ready-for-the-sec-climate-disclosure-rule

5 Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

6 https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

7 https://home.treasury.gov/news/featured-stories/the-inflation-reduction-act-and-us-business-investment

8 https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/green-deal-industrial-plan_en

For HSBC’s Transition Pathways survey, HSBC has worked with Kantar, a data, insights and consulting company. The survey is not wholly-representative of HSBC’s customer base and covers respondents across 375 key financial decision makers from businesses operating in the chemicals and industrials sector, comprising Discovery and Extraction (138 businesses), Processing (166 businesses) and Manufacturing (71 businesses). Key sub-sectors that were further identified were Chemicals and Plastics (74), Construction and Building Materials (68), Paper, Forestry and Glass (65), Steel (54) and other metals and minerals (43). Businesses were located in Europe (91), Asia (102), the Middle East (67) and North/Central America (115). Overall, 71 (19%) had a turnover below $50m, 87 (23%) had a turnover between $50 and $499m, 84 (22%) had a turnover between $500m and $2.5bn and 133 (36%) turnover in excess of $2.5bn. 110 (27%) had been established for less than 10 years and 265 (73%) for more than 10 years. Data was collected through an online questionnaire and the survey ran from 14 July to 1 August 2023.

In preparing this survey, HSBC has relied upon available data, information and responses given at the time of writing. This report should not form the basis of any third party’s decision to undertake, or otherwise engage in, any activity and third parties do not have any right to rely on it. Neither HSBC nor Kantar accept any duty of care, responsibility or liability in relation to this research or its application or interpretation, including as to the accuracy, completeness or sufficiency of it or any outcomes arising from the same.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (“HSBC”) and is for the exclusive use of the person to whom it is provided. It is intended for reference and illustrative purposes only. It does not constitute an offer or solicitation for, or advice or recommendation that you should enter into any transaction with HSBC or any of its subsidiaries or affiliates.

HSBC has based this Document on information obtained from sources it believes to be reliable but which it has not independently verified. All information contained in this Document (including without limitation, information about products, terms and conditions, pricing, forecasts, market influences and HSBC policy) is subject to change from time to time without any obligation on HSBC to give notice of such change to you.

HSBC makes no guarantee, representation or warranty and accepts no responsibility or liability for the contents of this Document and/or as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Document to the maximum extent permitted by law. You are responsible for making your own evaluation about the products referred to in this document. HSBC recommends that before you make any decision or take any action that might affect you or your business, you consult with suitably qualified professional advisers to obtain the appropriate financial, legal, accounting, tax or other advice.

© Copyright. The Hongkong and Shanghai Banking Corporation Limited 2023, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC.